How have the French been spending their money since the end of lockdown?

In the latest edition of its Payment Data/Impact Covid19 survey, CDLK gives an update on French people’s spending sector by sector as of August 21st. And the results are far from being equal.

Despite repeated calls from the government to consume, French spending seems to have dropped after a jump seen at the end of the lockdown.

This is clearly shown in the latest edition of CDLK’s Payment Data/Impact Covid19 survey*.

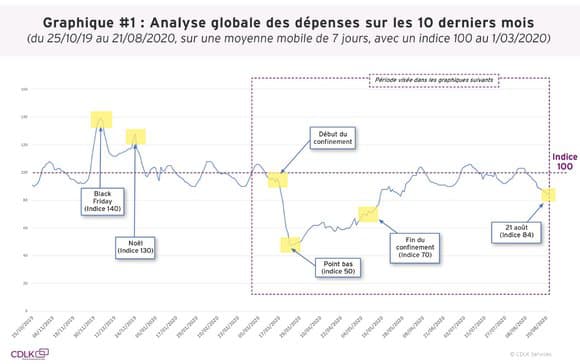

The spending index set at 100 on 1 March rose sharply from mid-May onwards, from 70 to over 100 in June and 106 in July (thanks to the sales period) before eventually falling back to 84 at the end of August, as shown in the graph below.

However, the sectoral discrepancies are still very significant. Overview:

Cafés, Bars & Restaurants

In July, the bars and restaurants category rose above the index value of 100, a first since March. “If bars & tobacconists were back at pre-crisis levels at the beginning of June, it is now the turn of restaurants to recover to a significant level at the beginning of July,” explains the study.

On the other hand, fast food restaurants have not broken the 100 mark and have been stagnating since the end of May at around 80.

Hotels & Accommodation

For the hotels, the holidays have naturally “favoured the sector, particularly boosting bookings for the month of July”. Seasonal rentals are profitable, with a peak in bookings in the first week of July, and the index jumped to 257.

The recovery in hotels has been much slower, and they only passed the 100 mark from the second week of August onwards. “This hides a likely contrast between hotels in seaside resorts and those in urban areas,” the firm comments.

Travel and Transport

No surprises for travel and transport, which after touching the zero mark during the confinement, slowly climb back up without being able to pass the 100 mark again. The index for the sector fell back to 35 on August 21st, with travel agencies and air transport obviously the most affected.

The maintenance-repair sector was one of the first to take off again, even during the lockdown, rising from 100 before May 15 to between 110 and 120 in June and July, an activity higher than that observed in early March.

The car rental sub-sector index gains 35 points in one week in early July. Rentals have been fairly stable since then, with a slight peak in the first week of August.

Fashion & AccessoriesGround transport, after having rebounded around 70 between July and August, fell back to 50 at the end of August. This means that activity is more than half the normal pre-confinement level (120 before 15 March).

Only maritime transport has almost returned to a level of normal activity, returning to the 100 mark in August before falling back to around 80 by August 21st.

Automobiles & motorbikes

“A peak in purchases was noticed at the launch of the summer sales (July 15th), from which the footwear sub-sector seems to have particularly taken advantage, reaching an index of over 260,” CDLK points out.

However, all indicators fell back to pre-crisis levels or even below 100 by mid-August, such as jewellery and watches (around 60) and fashion.

*This study is based on credit card spending among an anonymised sample of over 150,000 regular consumers. CDLK is analysing millions of anonymised credit-card expenditure data transiting on its platform to compare the evolution of French people’s expenditure before, during and after lockdown.