EU warns no return to pre-crisis economy before 2023

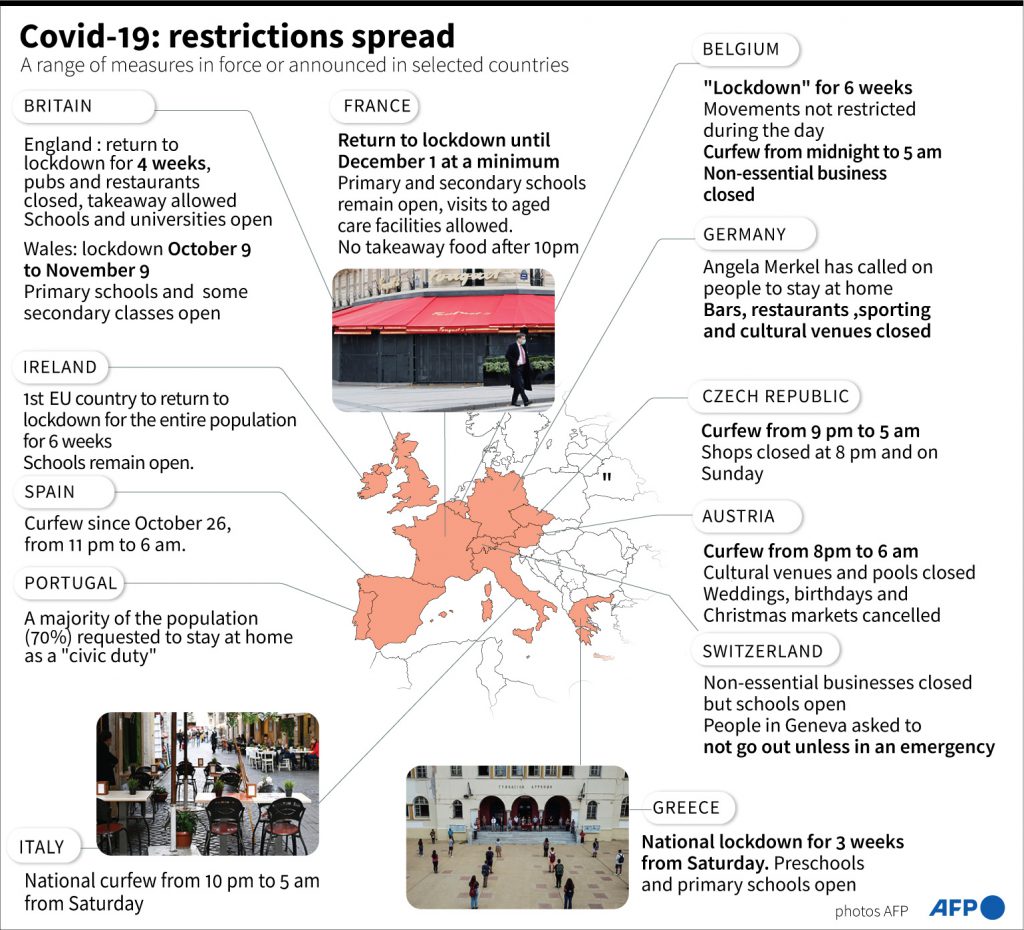

A second wave of the coronavirus pandemic has stalled a nascent recovery in Europe, as the EU warned that the economy would not return to pre-virus normality before 2023.

“The rebound has been interrupted,” the EU’s economic affairs commissioner Paolo Gentiloni told reporters Thursday as he announced new forecasts.

The soured outlook dashed hopes for a quick turnaround of the European economy and raised questions whether more stimulus would be needed to avert more lasting damage.

“We never counted on a V-shaped recovery. Now we know for sure that we won’t have one,” Gentiloni said.

‘Recovery on hold’

In its forecast, Brussels pointed to a whole series of danger signs, including higher unemployment and soaring debt levels for countries that will need to keep spending to revive their economies.

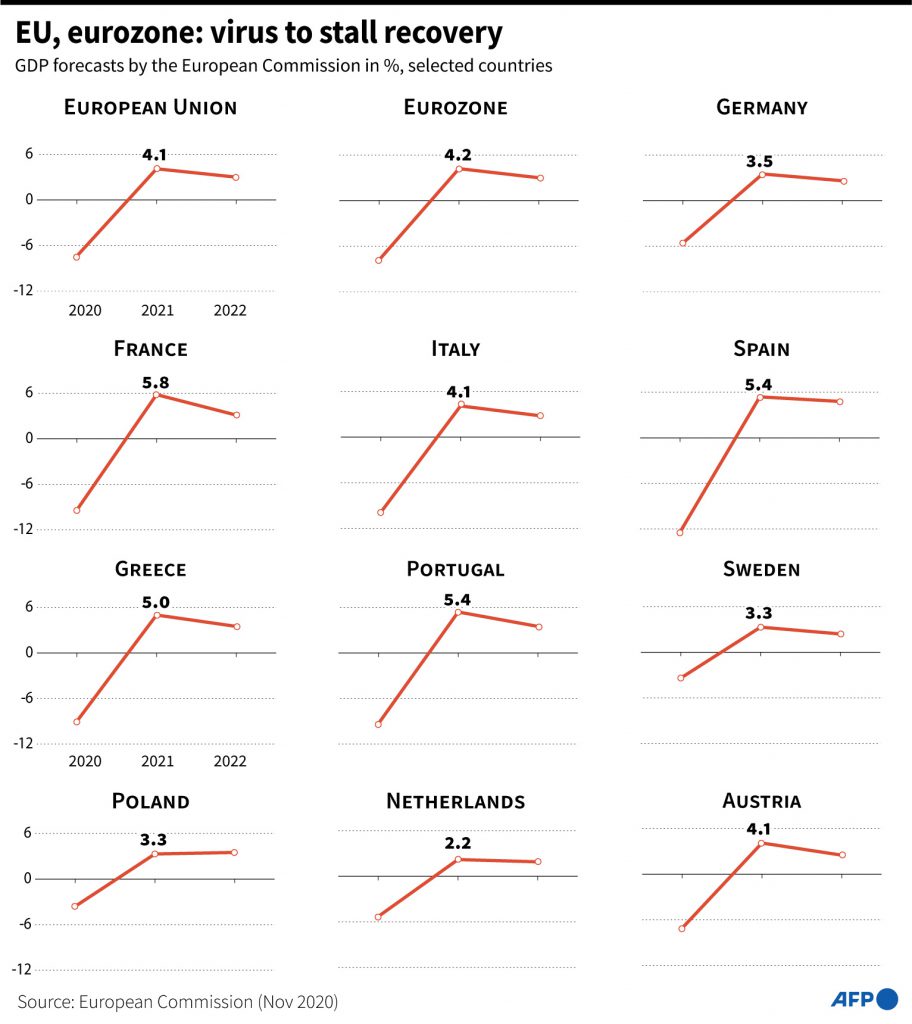

The European Commission said the eurozone economy would expand by just 4.2 percent next year, much lower than the 6.1 percent it predicted in July.

>>> READ ALSO – How contagious are kids with Covid? Short answer: we don’t know

In effect, renewed disruptions across the continent will “put the recovery on hold in the short term”, Gentiloni said, but added that the outlook was subject to “extremely high uncertainty”.

The loss of steam came despite a better-than-expected recovery in the middle of 2020 which limited the depth of this year’s historic recession.

The economy in the 19 countries that use the single currency would crash by minus 7.8 percent in 2020, instead of the minus 8.7 predicted earlier, the EU said.

But, unlike earlier hopes, EU economic output “will not return to pre-pandemic levels by 2022,” warned commission Vice President Valdis Dombrovskis.

>>> READ ALSO – EU to fund transfer of virus patients across borders

All 19 eurozone countries are mired in recession this year, but three are particularly hard hit — Spain with a dive of 12.4 percent, Italy at minus 9.9 percent and France at minus 9.4 percent.

Germany, the bloc’s leading economy, has limited the damage, with GDP expected to fall 5.6 percent in 2020.

The downturn has led member states to open the purse strings in the hopes of saving their economies and public deficits have widened to more than 10 percent in the case of France, Italy, Spain and Belgium.

As a clear consequence, the debt of the member states is expected to soar in 2020 and will exceed 100 percent of GDP in the eurozone as a whole.

The commission called on the European Central Bank to keep doing all it can to offset the negative consequences of this heavy debt.

The role and functions of the European Central Bank

So far, thanks to the ECB’s action, the financial markets have shrugged off the extra public spending with borrowing costs currently near record lows despite the high debt.

The EU also underlined the uncertainty of stalled post-Brexit talks, which “clearly weighs on the EU’s economic outlook,” Dombrovskis said.

Source: ednHUB / Agence France-Presse